It appears like a no-brainer that you would call your insurance agent after an automobile accident. If it's severe, it is a no-brainer. There are some circumstances when people bang-up or bruise their vehicle, and appropriately or mistakenly, declare to their good friends, household and the insurance gods "This is when not to submit an auto insurance coverage claim."Well, it depends upon your viewpoint.

The majority of them,, are categorized as home damage, implying there were no injuries or deaths. Simply put, fender-benders. These minor accidents happen in parking lots, residential streets and even driveways, and while they are reported to authorities, fender-benders are not always reported to the insurance provider of the chauffeurs included.

IN THIS ARTICLEHow to settle without insurance coverage, If you are ever in a fender-bender and are thinking about not submitting an insurance coverage claim, here are some essential things to do when settling a car accident without insurance. Take images of both automobiles and the scene where the mishap took place. Make no verbal contracts.

Fault Determination After An Accident: What You Should Know Things To Know Before You Buy

Get everything in writing. File the other car's license number, make, design and color. Write down the full name and contact info of the other motorist and their insurance coverage details. Even if your state doesn't require a police report, it is a good idea to get one. This report will be a main documentation of the automobiles and individuals included, any injuries, damage and what supposedly took place to trigger the wreck.

What to do in a minor car accident with no damage, Rather of submitting a claim, sometimes the motorists work out an arrangement to settle the matter between themselves. The reason, of course, is to avoid a claim from damaging the at-fault motorist's automobile insurance coverage rates for the next couple of years.

When not to file an automobile insurance coverage claim, While there are plenty of factors not to include your insurer with a fender-bender, lots of motorists keep their mouths shut hoping to prevent an exceptional increase. What will one claim do to your premium?

4 Simple Techniques For How Long Do I Have To Repair My Car After An Accident? - Hi ...

How much more you spend for coverage after a mishap depends on your insurance provider's guidelines and your state laws. Numerous other elements likewise enter play, chief among them are the kind of vehicle you drive, your age, where you live and your credit rating. Having said that, below you'll see the nationwide average increases for common accidents for a complete protection policy, based upon data offered by Quadrant Details Solutions.

"A record that shows one mishap however 3 questions in the last three years indicates a risky pattern and might result in a rate boost or cancellation."In nearly all cases, the rate boost is going to remain in impact for a minimum of 3 years. How to get your car repaired after an accident without insurance coverage, A fender-bender is a two-person affair, so you both require to be on the very same page before you proceed.

Making pledges to pay that you later on can't keep is a recipe for an insurance claim or a court date down the road. Another thing to consider if it was the other driver's fault, do you believe they'll really pay for your minor car accident? If you get the sense that they may struggle to pay for your minor damages, then you might wish to just get this resolved and file.

All about What Happens If You Have A Car ... - Gjel Accident Attorneys

states Kirchen. "The evidence remains in the documentation. If something goes awry you still have some means of recourse. Ultimately, in court, the person who has the proof will win if the other party only has hearsay."Snap pictures of both lorries before you move them in addition to close-ups of the damage on both vehicles.

Thomas Simeone with Simeone & Miller in Washington, D.C., says, "Take pictures of the automobiles and the accident scene if they will assist you. A police report is the ultimate documents if you end up in court.

At the very least the polices ought to offer you with a Motorist Exchange of Info kind. But often, if there was no serious damage, and if no one was harmed, you'll discover that the police won't come. It depends on the cops department's policy and probably how busy they are that day.

The Only Guide for After An Accident - Nc Doi - North Carolina Department Of ...

If you're of the frame of mind, "no mishap no police report" or "minor fender bender no authorities report," your instincts are probably. If the cops do not feel your car accident is worth coming out for, possibly it is something you ought to just work out with the other chauffeur.

Cops reports are only dispersed to insurance business by request," states Rauber."Your state may need a mishap report for accidents above a certain limit.

No matter what, be sure to have the following details prior to you leave the scene: Fixing your car, Concerning a contract at the mishap scene is only half the fight. Anticipate some back and forth prior to you come to a final resolution. Setting a deadline is very important; the longer it drags on, the more complicated a claim will end up being if you have to go to the other driver's insurance company.

Getting My What To Do After An Automobile Accident In North Carolina To Work

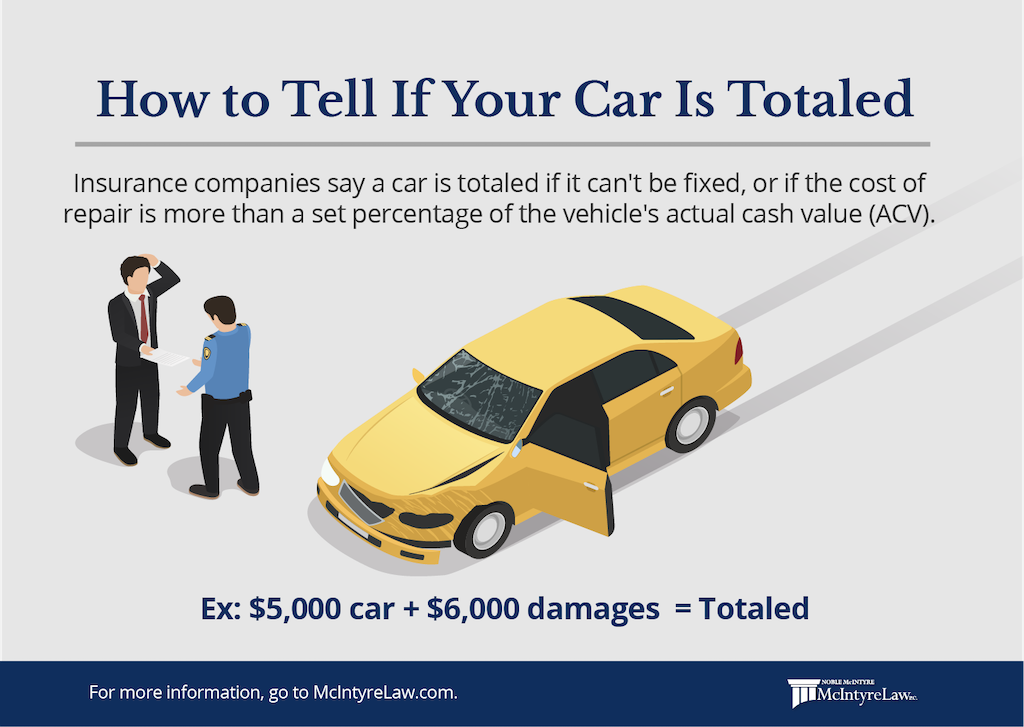

To begin, Kirchen recommends getting three estimates. "It is very possible the estimates will come back greater than either celebration expected. Hidden damage can frequently be expensive," he warns. If the estimate is expensive, it may be time to get the insurance provider included. Once again, it isn't illegal or wrong to try and work things out by yourself, and so nobody will hold it versus you that you initially explored how to get your automobile fixed after an accident without insurer involved.

Putting a cars and truck accident behind you, When the automobile is all set to get back on the road, there should be some final documents, especially if you are at fault. The at-fault party will desire to ensure that the repairs end the incident. Kirchen suggests getting the other party to sign a release of claims, more delicately understood as a for automobile mishap type."This ensures that the other party can not come back to you stating they desire to be paid for diminution of worth or that they suddenly have injuries," he encourages.

"If you are the one injured and receiving cash, try to avoid signing a release, so that you have the right to look for more cash at a later date, if essential."Still, if you are injured, you probably ought to call your insurance provider instead of putting this experience in the "when not to submit an automobile insurance coverage claim" container.